Commercial real estate acquisition and development

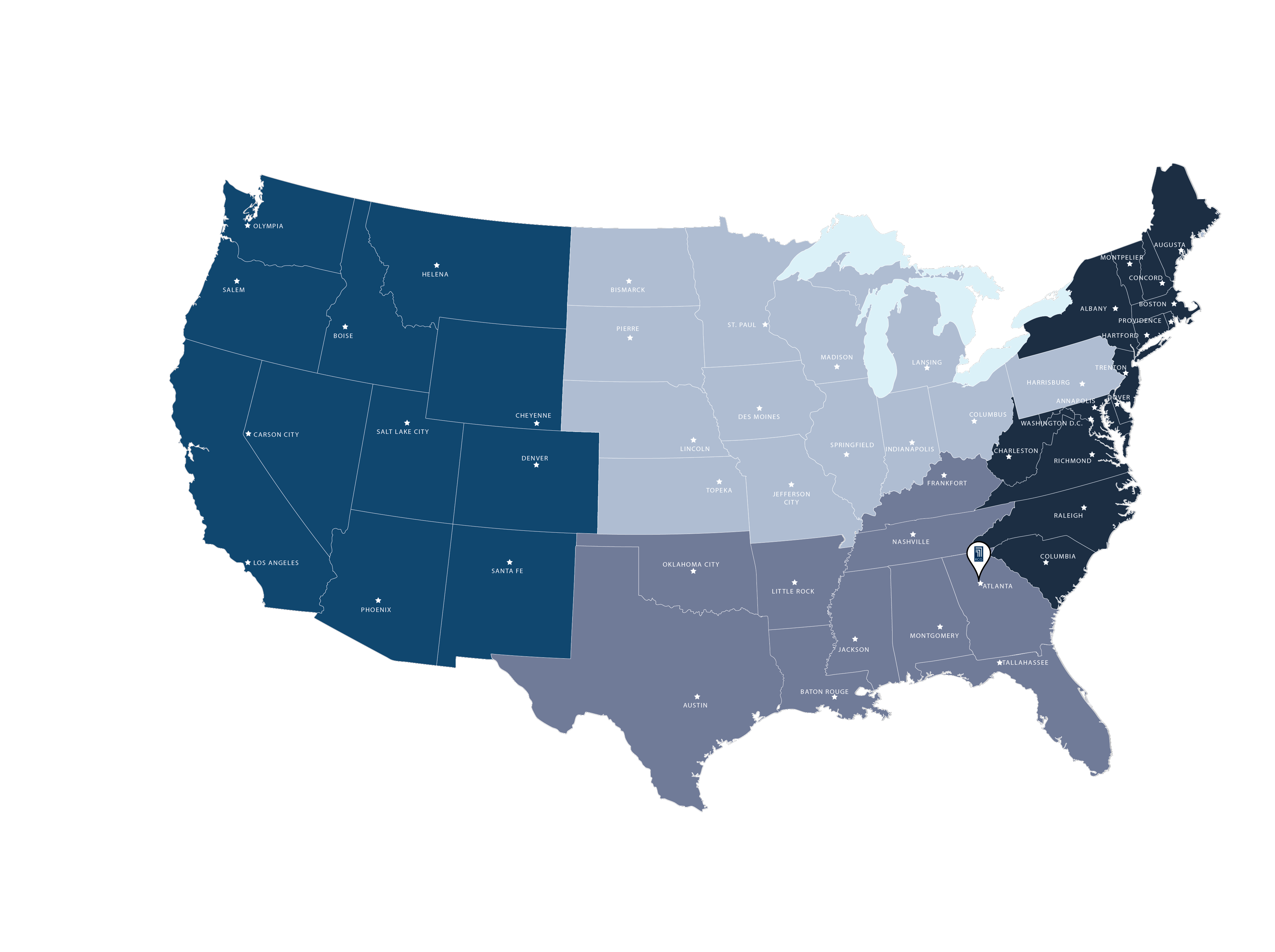

RCG Ventures, LLC (“RCG”) is a privately-funded real estate investment group that acquires and develops commercial real estate in the United States. We primarily focus on multi-tenant, anchored shopping centers with the potential for long-term ownership.

Acquisitions

Portfolio

Dispositions

About RCG Ventures

RCG Ventures, LLC (“RCG”) is a privately funded real estate investment group that acquires and develops commercial real estate in the United States. The company’s primary focus is multi-tenant, anchored shopping centers with the potential for long-term ownership.

Our Mission

To be the preeminent owner and operator of multi-tenant, retail real estate in suburban and secondary markets throughout the United States.

Investment Platforms

Stabilized Assets

RCG is actively acquiring well-located, stabilized assets that provide opportunity for long term ownership and cash flow. These assets generally include a blend of national, regional and local tenants with extended lease term, contractual rent growth, market or below-market rents and strong sales. Through RCG’s vertically integrated structure, RCG operates these assets in a first-class manner with the goal of long-term ownership.

Value-Add Projects

RCG’s platform includes the acquisition of existing properties that are undervalued, underperforming, or need to be repositioned. These assets have significant upside and are commonly referred to as “value-add” projects. Our strong tenant relationships, combined with our capital strength and operating experience, allow us to reposition assets quickly and efficiently.

Opportunistic-Redevelopment

RCG’s opportunistic and redevelopment initiative focuses on real estate that is distressed, in transition, or whose underlying real estate provides the opportunity to unlock value through a higher and better use. This platform focuses on repositioning existing assets through modification and reconfiguration of the improvements in order to attract quality retail tenants or alternative uses.

Joint Ventures

On a selective basis, RCG is willing to enter into a joint venture partnership for new acquisitions, new developments, or a recapitalization. These transactions can be structured as a joint venture, mezzanine debt, or other method to facilitate the transaction.